As interest rates start to ease across Australia, the big question on every property investor’s mind is: “What does this mean for me?” We spoke with Hung Chuy, Director and Finance Strategist at Strategic Brokers, to unpack what this rate shift means for borrowing capacity, market confidence, and real opportunities for investors — new and experienced.

Are Australians Really Jumping Back into the Market?

Yes — and fast. “We’ve been absolutely hammered with enquiries since the first RBA rate cut — and even more after the second,” Hung says. Investors with equity are reactivating, and upgraders are flooding in, driven by urgency and fear of being priced out.

Who's Leading the Charge — First-Timers or Seasoned Investors?

Both. Seasoned investors are confident and acting fast, while first-time investors are cautiously optimistic and focusing on education. Hung notes a sharp increase in enquiries across all levels, especially among those with existing equity.

Is It Just Confidence or Are New Opportunities Really Opening Up?

It’s both. Lower rates increase borrowing capacity and affordability, but there’s also a powerful psychological trigger. A 0.25% cut can mean 5% more borrowing power. That boost is real — and it’s getting people off the fence.

What Types of Properties Are Investors Targeting Now?

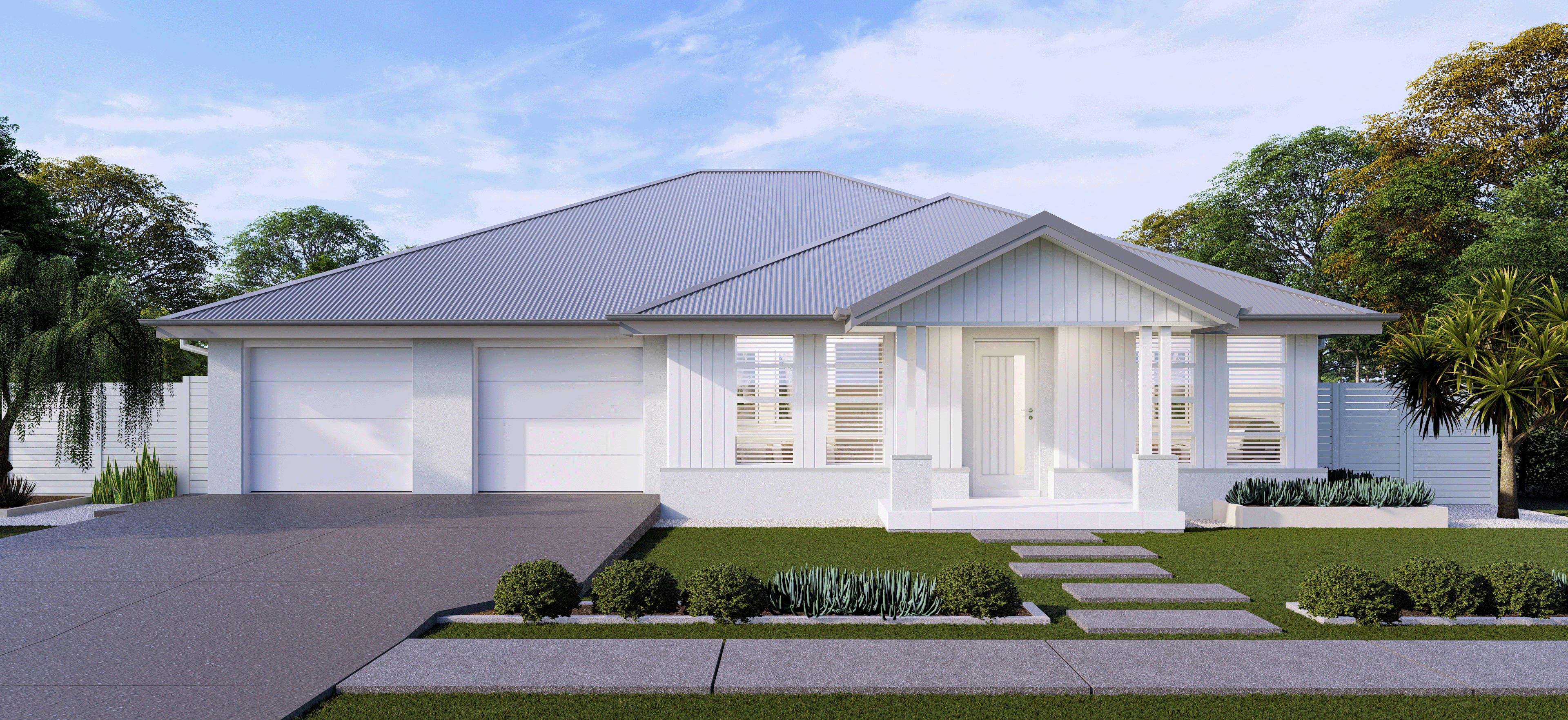

Affordable housing is hot. House-and-land packages on the metro fringes — Campbelltown, Central Coast, and The Hunter Region — are in high demand. They’re low-maintenance, yield strong rental returns, and are positioned for growth.

Regional Migration Is Real

Cities like Perth, Brisbane, and Adelaide are booming thanks to affordability, lifestyle, and infrastructure upgrades.

How Are Investment Strategies Shifting?

Today’s investors are smarter.

- Rentvesting is rising.

- More focus on cash flow and tax minimisation.

- Investors are doing their homework via podcasts, videos, and online education.

People aren’t just buying anything anymore,” Hung explains. “They’re building long-term wealth with purpose.”

Borrowing Power Is Up — But Don’t Overextend

A bigger budget doesn’t always mean you should spend more. Hung cautions, “The banks test you at 3% above current rates. That doesn’t mean you can comfortably afford that maximum. Know your lifestyle and limits.”

What New Loan Products or Incentives Are Out There?

The lending landscape is evolving — fast. Here are three standout options making property more accessible right now:

5% Deposit Scheme (Starting Jan 2026)

From early 2026, eligible first-home buyers can purchase with just a 5% deposit, no LMI, and no income cap — backed by a 15% government guarantee. With property price caps increasing (up to $1.6M in Sydney), this scheme is set to transform market access. We’ll explore this in full in a follow-up article.

Family Guarantee Loans

Get into the market with zero deposit if a parent or relative guarantees part of your loan. It’s a powerful way to fast-track buying without needing a huge savings buffer.

Low-Doc Loans

Ideal for self-employed buyers, low-doc loans use alternative income verification (not just tax returns), helping more Australians qualify without unnecessary delays.

Hung regularly joins client tax planning sessions to optimise income structures and borrowing power. “A great broker + accountant combo can unlock $1M+ in additional finance capacity.”

What Questions Should You Ask Before Buying?

Hung shares the top investor questions:

- Can I afford it?

- What should I buy?

- Where should I buy?

His advice: Get educated first. Listen to property podcasts. Understand the basics. Then speak to experts.

Where Should You Start?

- Know your borrowing power.

- Clarify your goals and risk tolerance.

- Build a team of trusted advisors.

- Start small. Scale smart.

Final Thoughts: Real Advice Needs a Real Team

With rates falling and buyer sentiment rising, the next 6–12 months present a real opportunity. But success doesn’t come from guesswork.

“Build your team. Find people who’ve done it themselves — they’ll help you avoid mistakes and accelerate your success,” Hung advises.

At Strategic Brokers, Hung and his team help investors structure finance strategies to unlock real wealth. And with Haverton Homes, Gain access to proven, personalised property packages in high-growth areas — backed by a trusted team and end-to-end support that maximises tax savings, rental income, and capital growth.

Together, Haverton Homes and Strategic Brokers offer the full-circle guidance today’s investors need.

Real People. Real Journeys.

Want to see how this strategy works in real life? Hear from everyday Australians who started their property investment journey with us:

• Pravin’s Story: From First-Time Investor to Financial Security

• Hester and Elizabeth: Securing Their Retirement Dreams Through Property Investment

• Harinder and Preet: Achieving Financial Success and Peace of Mind Through Property Investment

You can watch their full testimonials and hear more inspiring stories 👉 [havertonhomes.com.au/testimonials]

No Secrets. Just Action.

If you’ve been waiting for the “perfect time,” you’re not alone. But the truth is, every year you wait, costs rise, opportunities shrink, and your long-term return erodes.

Success in property isn’t about timing the market—it’s about time in the market.

So here’s the truth:

• There’s no secret.

• There’s no shortcut.

• But there is a proven path—and a team ready to walk it with you.

As one of our clients said, “It’s about empowering yourself with the right people around you. If you do that, you’re on a winning ticket.”

Ready to Take the Next Step?

Are you ready to stop guessing and start making informed property decisions?

Are you ready to stop guessing and start making informed property decisions?

Let us help you with real numbers and a clear path forward.

Get Your Free Personal Investment Starter Pack and receive a tailored report that includes:

• Weekly Cashflow Analysis

• Tax Saving Report

• Home Loan Payoff Plan

• Capital Growth Forecast

Make Informed Property Decisions Today. Stop guessing. Use real numbers based on your curent tax position.

Get your FREE Investment Starter Pack and start planning with clarity.

Your future self will thank you.

🕒 Limited packs available each week — don’t miss out.